Labour Market Report – April 2025

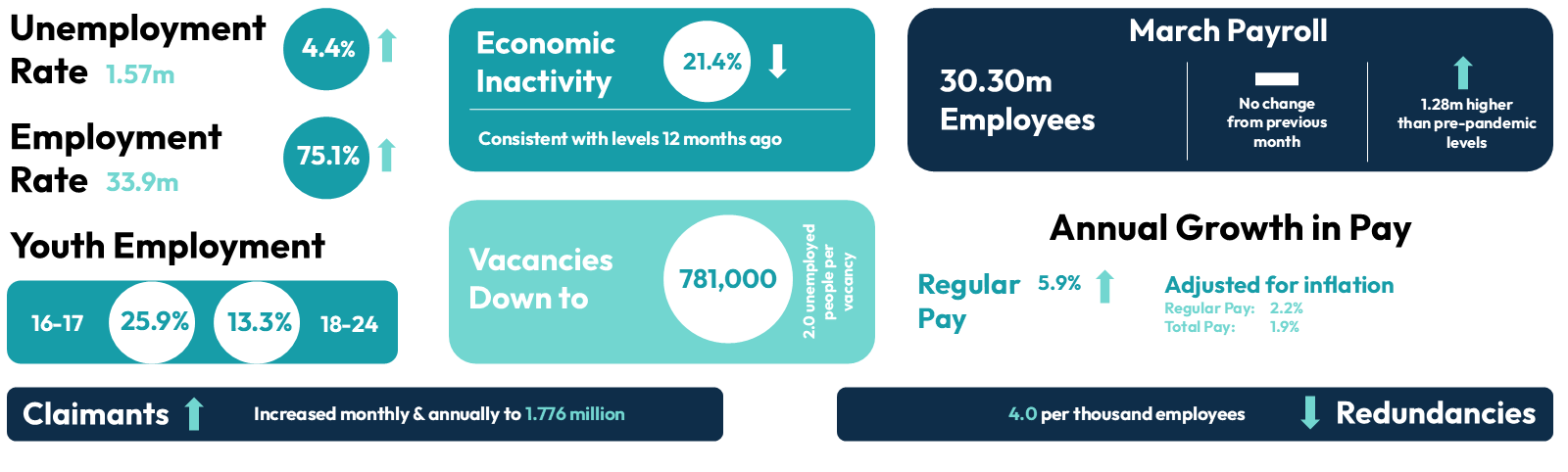

The latest ONS Labour Market Overview shows that:

The latest ONS Labour Market Overview shows that:

The British Chamber of Commerce latest Quarterly Recruitment Outlook found:

The Resolution Foundation Briefing Minimum Wage, maximum pressure looks at the impact of the 2025’s minimum wage and employers NICs increases. It says that most workers will end up absorbing much of the higher NICs in the form of lower pay but of course, pay cannot fall for workers at or near the minimum wage. The Resolution Foundation judge that the combined effect of these changes will reduce total employment by 80,000, especially amongst low paid workers.

Totaljobs’ latest research focused on what benefits workers want and found the top motivator was still salary (72%), but benefits play a crucial role in job satisfaction. 66% of workers say they would forgo a pay rise for their most desired benefit: flexible working.

The ‘Keep Britain Working Review’ led by Sir Charles Mayfield found:

Unemployment is expected to peak at 1.6 million in 2025. The Government has announced the rollout of the new Employment Support programme, with West London becoming the first area to receive funding under the DWP’s ‘Connect to Work’ programme. This programme aims to support 100,000 people per year. A £42.8 million investment will fund five years of tailored support to disabled people, those with health conditions and people facing complex barriers to employment. Additionally, the government has also launched the first of nine ‘trailblazer’ initiatives focussed on tackling economic inactivity and boosting employment. The pilot scheme in South Yorkshire will support 7,800 people in its first year, with the goal of helping up to 3,000 individuals return to, or remain in work.

HR Grapevine reports that it is one year to go before the state pension age rises to 67. This will be the age at which most Britons can realistically consider retiring. But are employers ready to have more older employees? There is concern that at the very time workplaces will start to get even older, age bias and discrimination is not improving. Data suggests that older workers receive less training than young workers, and age discrimination is the one form of discrimination that employees feel the most. Gem Partnership can support with a free training skills needs analyse for your workforce encompassing all areas of the team, allowing for both short term and longer-term organisational goals. Contact Kelly.lee@gempartnership.com

LinkedIn’s inaugural report Skills on the Rise 2025 looks at the fastest-growing skills in today’s world of work. LinkedIn data reveals that by 2030 70% of the skills used in most jobs will change, with AI emerging as a catalyst. The top fastest-growing skills in the UK today are Relationship Building, Strategic Thinking and AI Literacy.

The KPMG and REC, UK Report on Jobs: North of England highlighted that the number of people placed into permanent roles across the North of England decreased further in April, thereby stretching the current run of contraction to 22 months. Surveyed recruiters linked the downturn to hiring hesitancy due to recent rises in payroll costs and a reduction in the number of job openings. Whilst the rate of contraction was the least pronounced for eight months and softer than the UK average, it remained historically sharp overall, and contrasted with the survey’s long-run trend of rising placements. April’s data signalled a further drop in billings from the employment of short-term and temporary staff across the North of England. Some employers were reportedly reluctant to hire due to the increase in National Insurance and concerns around costs.

April survey data highlighted another sharp reduction in vacancies for permanent staff across the North of England. However, the downturn showed further signs of easing, with the rate of contraction the slowest seen in 2025 to date. The rate of decline in temp vacancies in the North of England likewise softened in April. The pace of contraction was the softest seen in the year to date, albeit solid overall. Job vacancies for both types of staff in the North of England fell at slower rates than seen on average across the UK as a whole.

The start of the second quarter saw permanent staff availability in the North of England rise for the sixteenth month in a row. The rate of expansion eased only slightly from March’s recent high and was the second-sharpest since December 2020. Recruiters linked the upturn in candidate numbers to increased redundancies. Recruiters based in the North of England indicated a rise in temp staff availability in April, stretching the current trend of growth to 26 months. Although the rate of expansion was softer than in March, it was sharp by historical standards. Panellists reported that the latest increase reflected a combination of redundancies and reduced demand for short-term staff.

North of England recorded a slower rise in starting salaries than that seen at the UK level. Average hourly rates of pay for short-term staff across the North of England rose in April, extending the current trend of growth to nearly one-and-a-half years. The rate of inflation was the most pronounced since June 2024 and solid. Panellists widely reported that stronger than average increases in the national minimum and living wage rates it what attributed to the raise in payrate.

GEM are looking forward to working with our clients advising on all forthcoming changes initiated from the Employment Rights Bill and associated policy changes, impacting our industry sector. As a training provider we are also working with all relevant governing bodies to stay at the forefront of changes by Skills England. GEM hold direct funding and are able to support with a range of upskilling and staff development programmes to aid your workforce development.

I would welcome the opportunity to discuss the changing landscape with you and outline the support and programmes we offer that can enhance your People plans.

https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment

https://www.resolutionfoundation.org/app/uploads/2025/03/Minwagemaxpressure-1.pdf

https://www.totaljobs.com/advice/uk-salary-benefits-2025-the-ultimate-guide-to-career-growth-and-opportunities

https://www.cipd.org/uk/about/press-releases/covid-pandemic-five-years-on/#:~:text=says%20the%20CIPD-,Employers%20still%20grappling%20with%20the%20effects%20of%20the%20Covid%20pandemic,and%20growing%20economic%20inactivity%20remain.

https://www.gov.uk/government/publications/keep-britain-working-review-discovery/keep-britain-working-review-discovery

https://www.gov.uk/government/news/rollout-begins-on-new-employment-support-programme-with-40-million-boost-to-west-london

https://www.gov.uk/government/news/south-yorkshire-kicks-off-125-million-plans-to-get-britain-back-to-health-and-work

https://www.hrgrapevine.com/content/article/2025-04-10-are-employers-really-ready-to-have-more-older-employees?utm_source=search-list&utm_medium=search&utm_campaign=Are+employers+%27really%27+ready+to+have+more+older+employees%3F

https://ageing-better.org.uk/resources/summary-report-state-ageing-2025?gad_source=1&gad_campaignid=15353176687&gbraid=0AAAAACS1nFCHDJQ4v_p_kvLylk-xuzC2r&gclid=EAIaIQobChMI1_vI25KgjQMVwplQBh297wBgEAAYASAAEgIsh_D_BwE

https://www.linkedin.com/business/talent/blog/learning-and-development/skills-on-the-rise

https://www.forcesemployment.org.uk/programmes/op-ascend/

https://www.gov.uk/government/news/leading-food-experts-join-government-food-strategy-to-restore-pride-in-british-food

https://kpmg.com/uk/en/media/press-releases/2025/04/kpmg-and-rec-uk-report-on-jobs.html

https://ukandeu.ac.uk/britains-migrant-jobs-boom-continued/#:~:text=New%20HMRC%20data%20on%20’payrolled,UK%20origin%20are%20roughly%20flat.

https://www.gov.uk/government/statistics/uk-payrolled-employments-by-nationality-region-industry-age-and-sex-from-july-2014-to-december-2024/uk-payrolled-employments-by-nationality-region-industry-age-and-sex-from-july-2014-to-december-2024