Labour Market Report – July 2025

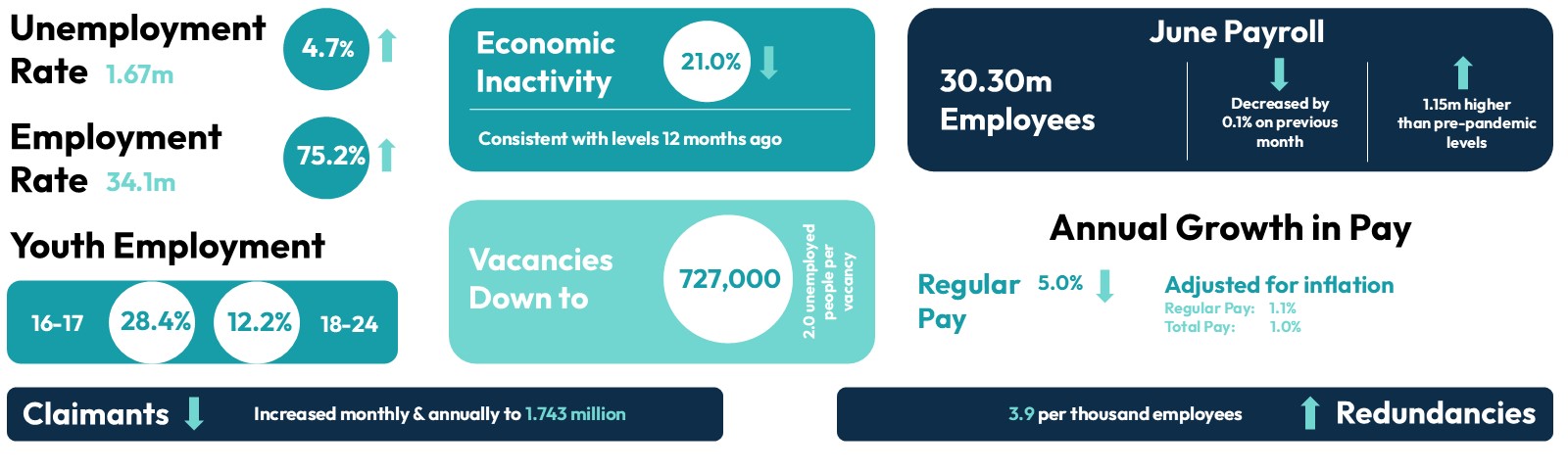

The latest ONS Labour Market Overview shows that:

Indeed’s Hiring Lab Mid-Year Labour Market Update shows the labour market continues to soften but hasn’t crashed since April’s policy changes came into effect. Key trends include:

The Home Office announced new rules to be laid in Parliament which will see skills and salary thresholds rise, overseas recruitment for care workers end, and more than 100 occupations no longer granted access to the immigration system. These changes, the first to be rolled out from the Immigration White Paper, represent a fundamental shift in the UK’s government’s approach to immigration and restoring order to the points-based system, focusing on higher skills, lower numbers and tighter controls were implemented on 22nd July.

The UK and France have announced a major deal to crack down on illegal Channel crossings.

A new pilot scheme will see small boat arrivals being returned to France then an equal number of migrants will be able to come to the UK from France through a new legal route – fully documented and subject to strict security checks.

The Government published a comprehensive roadmap on the 1st July listing the expected timeframes for consultation and implementation for the various measures in the Employment Rights Bill. The Employment Rights Bill completed its Report Stage in the Lords on the 14th July with the Third Reading scheduled for 3rd September when Parliament returns from recess.

Draft legislation to tackle tax non-compliance in the umbrella company market has been published on 21st July, confirming a major policy change that will come into effect from 6 April 2026. Under the new rules, responsibility for deducting and paying income tax and National Insurance will shift from umbrella companies to recruitment agencies – or, where no agency is involved, to the end client.

The move follows widespread concerns about fraudulent activity and tax avoidance in parts of the umbrella sector. This is a much-welcomed addition for those businesses who operate compliantly as a number of such schemes have been linked to disguised remuneration schemes, payroll fraud, and the misclassification of workers. These practices often leave workers at risk of unexpected tax bills and reduce the overall tax take. The government’s policy response aims to protect workers, clamp down on tax abuse, and ensure a level playing field for compliant businesses. By placing tax obligations on parties higher up the labour supply chain, such as agencies or clients, HMRC expects greater compliance and more effective enforcement. HMRC will also continue to monitor and warn workers in real time where signs of non-compliance are detected.

The Director for Labour Market Enforcement (DLME) has published the UK Labour Market Enforcement Strategy for 2025/26 with an annual assessment of the scale and nature of labour exploitation with recommendations to the enforcement bodies. This strategy is the final annual plan before responsibility transfers to the newly established Fair Work Agency (FWA) next year. The strategy sets out key recommendations for the Department for Business and Trade (DBT), which is overseeing the creation of the FWA – a single enforcement body that will consolidate the work of HMRC’s National Minimum Wage team (HMRC-NMW), the Gangmasters and Labour Abuse Authority (GLAA), and the Employment Agency Standards Inspectorate (EAS).

Recognising the transitional nature of the year ahead, the DLME makes four specific recommendations to DBT to ensure that the FWA is established on strong foundations and is capable of effectively addressing labour market non-compliance:

KPMG and REC, UK Report on Jobs: North of England reports that July survey data signalled a further drop in permanent placements across the North of England, thereby stretching the current period of decline to just over two years. Anecdotal evidence indicated that the latest reduction was due to lower demand for permanent staff and recruitment budget constraints. The rate of decline was rapid and the fastest in four months, although it remained noticeably softer compared to those seen earlier in the year. Recruitment consultancies in the North of England registered a ninth consecutive monthly decrease in billings for temp staff in July. Panellists often mentioned that the fall was reflective of tighter client budgets. However, the North of England recorded a softer decrease in temp billings compared to the UK average.

July data signalled a ninth consecutive monthly decrease in demand for permanent and temp staff in the North of England. The reduction in permanent vacancies was not as sharp as the UK average, as the North of England recorded the softest drop in permanent job openings of the four monitored English areas. The downturn in temp vacancies was the strongest since March and sharp, and broadly in line with the UK trend.

Permanent labour supply has risen at strongest rate in four months and redundancies were cited as a key driver of growth, with panellists also linking the rise in supply to a mismatch of skills and available roles. The number of candidates seeking temporary positions in the North of England rose further at the start of the third quarter. The rate of growth was not only substantial, but the joint-sharpest in over four-and-a-half years (on a par with March 2025). According to recruiters, the pool of available temp workers had increased due to fewer contract opportunities.

The seasonally adjusted Permanent Salaries Index posted above the crucial 50.0 mark again in July, to signal a fourth consecutive monthly rise in starting salaries across the North of England. Panellists mentioned that pay had increased to attract and secure sought-after skills. After falling modestly in June, temp pay in the North of England increased in July. Although the rate of wage growth was below trend and only modest overall, it was stronger than the UK-wide average. According to anecdotal evidence, average hourly rates of pay for temporary staff were raised as a result of increased competition for suitably-skilled workers.

GEM are looking forward to working with our clients advising on all forthcoming changes initiated from the Employment Rights Bill and associated policy changes, impacting our industry sector. As a training provider we are also working with all relevant governing bodies to stay at the forefront of changes by Skills England. GEM hold direct funding and are able to support with a range of upskilling and staff development programmes to aid your workforce development.

I would welcome the opportunity to discuss the changing landscape with you and outline the support and programmes we offer that can enhance your People plans.

https://www.gov.uk/government/publications/industrial-strategy

https://www.gov.uk/government/publications/hmrc-transformation-roadmap/hmrcs-transformation-roadmap

https://www.gov.uk/government/news/major-immigration-reforms-delivered-to-restore-order-and-control