Labour Market Update – September 2023

As a leading provider of human resource solutions across the region we wanted to share with you latest trends and insight for the month of September.

The latest ONS Labour Market Overview reported:

The CIPD latest Summer 2023 Labour Market Outlook reported that many employers have hard to fill vacancies, particularly in the public sector. Those facing hard to fill vacancies are doing everything from upskilling staff, to raising wages, to tackle them. To retain staff many employers are even making counteroffers. Key findings:

The Food and Drink Federation has published its State of Industry Report Q3 2023. It found that labour shortages cost businesses £1.4bn over the last year, with companies being forced to leave vacancies unfilled and reduce production – all of which contributes to rising wage bills, higher prices, and stifles growth, which is vital for a strong economy.

The latest Report on Jobs produced by the REC and KPMG reports that overall permanent billings in August decreased. The data shows pay pressures remain sharp for permanent workers and temp wages also increased across all four English regions, with London seeing by far the steepest rate of pay inflation, and in Scotland. This is partly because of a shortage of labour with specific skills.

Demand for both permanent and temporary staff increased during August, but temp staff demand expanded at a solid pace. Moreover, labour supply also increased during August for permanent and temp staff.

HR Review reported that employment support services provided by local job centres have come under heavy criticism in a recent report by the Institute of Public Policy Research (IPPR). The study suggests that the current approach, based on financial conditionality, is failing both job seekers and employers, leading to inappropriate job applications and wasted resources. IPPR calls for a complete overhaul of Jobcentre support services to create a new universal service focused on quality rather than quantity.

The Department of Works and Pensions Resettlement Team, have advised that many refugees have now been transferred to being the responsibility of local authorities. This is in line with a statement made by Robert Jenrick, the immigration minister. This change means that many refugees are now linking in with local jobcentres to find work. There is estimated to be around 12,000 Afghans and 80,000 Ukrainians that are seeking work.

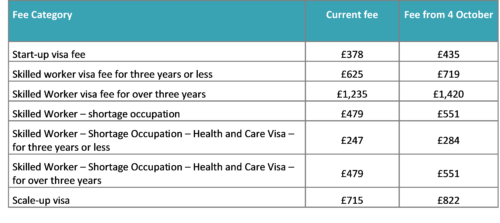

Home Office immigration and nationality fees go up on the 4th October 2023. The Sponsor Licence fee for small and large sponsors will remain the same as will the cost of the priority fees for sponsors, however, the fee for assigning a certificate of sponsorship will be increasing from £199 to £239 from 4th October 2023. The fee increases will have a more significant impact on the individual’s visa and related fees. Therefore, employers who provide assistance with these fees should be mindful of these change increases also. Examples of increases for individuals include:

Please note the list provided is not exhaustive. Given that each candidate’s immigration process often involves multiple applications, the cumulative additional cost can become substantial.

Additionally, it’s important to be aware that the Immigration Health Surcharge (IHS) is also due to increase at some point this Autumn (exact date to be confirmed), rising from £624 to £1,035 per person per year for most primary applicants.

References

https://www.gov.uk/government/news/local-communities-welcome-hundreds-of-refugee-families