National Insurance Rate Cut

With these changes occurring in January rather than the typical case of April, employees should start benefitting from the cut in their first pay of the year. However; both national insurance and income tax thresholds, which determine when you start paying tax are frozen until April 2028.

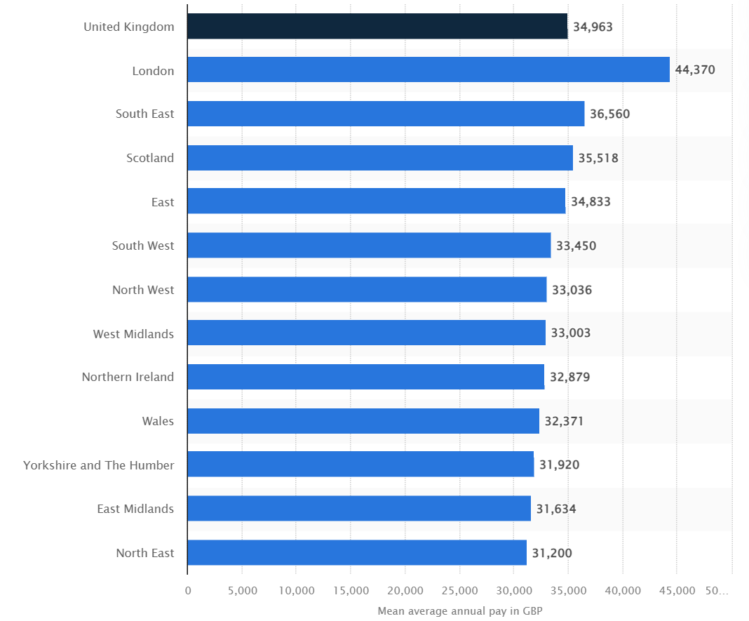

In November 2023, the Office for National Statistics published a data set which showed the North East region as the lowest mean average annual pay in the country:

Based on this annual salary of £31,200, the “average” North East worker could be set to see their take home annual pay, £372 a year higher. Given the ongoing cost of living issues the country is facing, these cuts should be a welcome relief.

To see how these cuts may effect you: https://www.moneysavingexpert.com/tax-calculator/

If you’d like to receive our newsletters, complete the form in footer of the website. You will be able to unsubscribe at any time.

You can follow us on social media here: LinkedIn, Twitter, and Facebook.